Where Will Rocket Lab Stock Be in 10 Years?

The spaceflight company has shot up like, well, a rocket since its market debut a few years ago.

The space economy is growing at an unheard-of pace. Soon, SpaceX may even have artificial intelligence (AI) data centers in orbit, powered by its gigantic Starship system. However, you cannot invest in SpaceX stock as an individual investor today. You’ll have to wait for its proposed initial public offering (IPO), rumored to happen later this year.

So how does a retail investor get a slice of that sweet space economy pie? One publicly traded space economy stock is Rocket Lab (RKLB 7.50%). It is one of the only companies competing directly with SpaceX for launch contracts, and its revenue has grown by close to 900% in the last five years.

Image source: Getty Images.

Where will Rocket Lab stock be in 10 years? And is it a buy for your portfolio today?

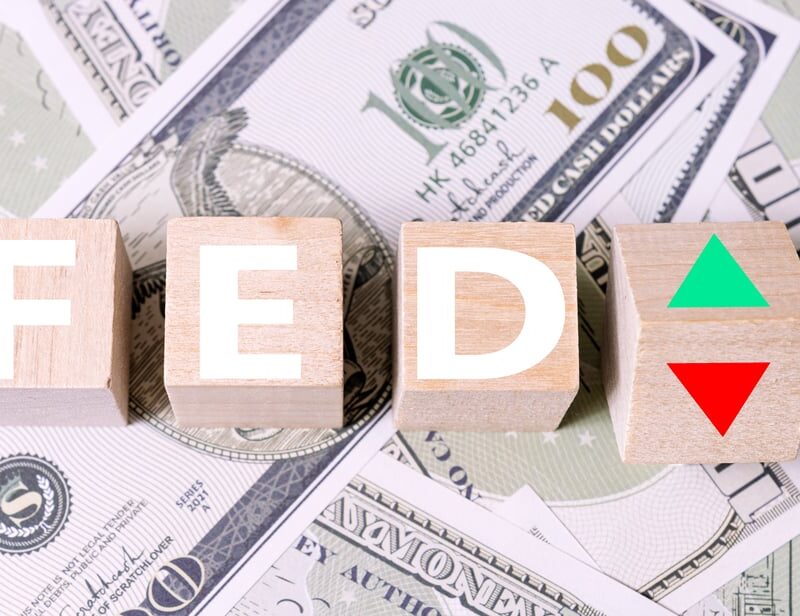

Today’s Change

(-7.50%) $-5.74

Current Price

$70.84

Key Data Points

Market Cap

$38B

Day’s Range

$69.42 – $78.21

52wk Range

$14.71 – $99.58

Volume

523K

Avg Vol

23M

Gross Margin

28.93%

Ambitious expansion plan

Rocket Lab is a rocket launch provider for both commercial and military use cases, using its small Electron rocket to deliver small payloads to orbit with precision. It has now been reliably (and safely) operating this launch system for years, with a backlog that totaled over $500 million last quarter.

Building on the Electron, Rocket Lab has expanded into new areas of the space economy, including satellite design for its customers. This is its space systems segment, which now generates over $100 million in quarterly revenue and is much larger than its launch segment in terms of sales.

In the future, Rocket Lab will continue launching the Electron and plans to expand its capabilities in space systems. However, its most important expansion plan is its newer Neutron rocket, which will be significantly larger than the Electron and deliver much larger payloads. This will help Rocket Lab compete directly with SpaceX for launch contracts and could lead to $50 million in revenue per launch, using SpaceX contracts as a proxy.

Where will Rocket Lab stock be in 10 years?

The Neutron testing and commercial deployment have been slightly delayed, but the company is close to the finish line and hopes to perform its first test/commercial launch in 2026. Once it’s ready, the Neutron will significantly grow Rocket Lab’s revenue. One launch at a $50 million sale is close to 10% of Rocket Lab’s trailing revenue of $554 million.

In 10 years, you could see Rocket Lab performing dozens of launches every year with its Electron and Neutron rockets. On top of this, it will likely have greatly expanded its capabilities in space systems, offering bundled packages to commercial and military customers for contracts. It may even have its own satellite constellation, which management has hinted at building. Altogether, this could lead to billions of dollars in revenue.

The issue for Rocket Lab is that the stock may already be pricing in a lot of this growth. It currently has a $40 billion market cap, with significant future shareholder dilution expected. Even if the business reaches $10 billion in revenue, the low margins in the spaceflight industry will make it difficult for the company to generate enough profit to justify this sizable market cap.

Rocket Lab stock is unlikely to perform well for investors over the next 10 years.

No comments

Be the first to comment.