MARKET CALL: A Loopy Stock Market

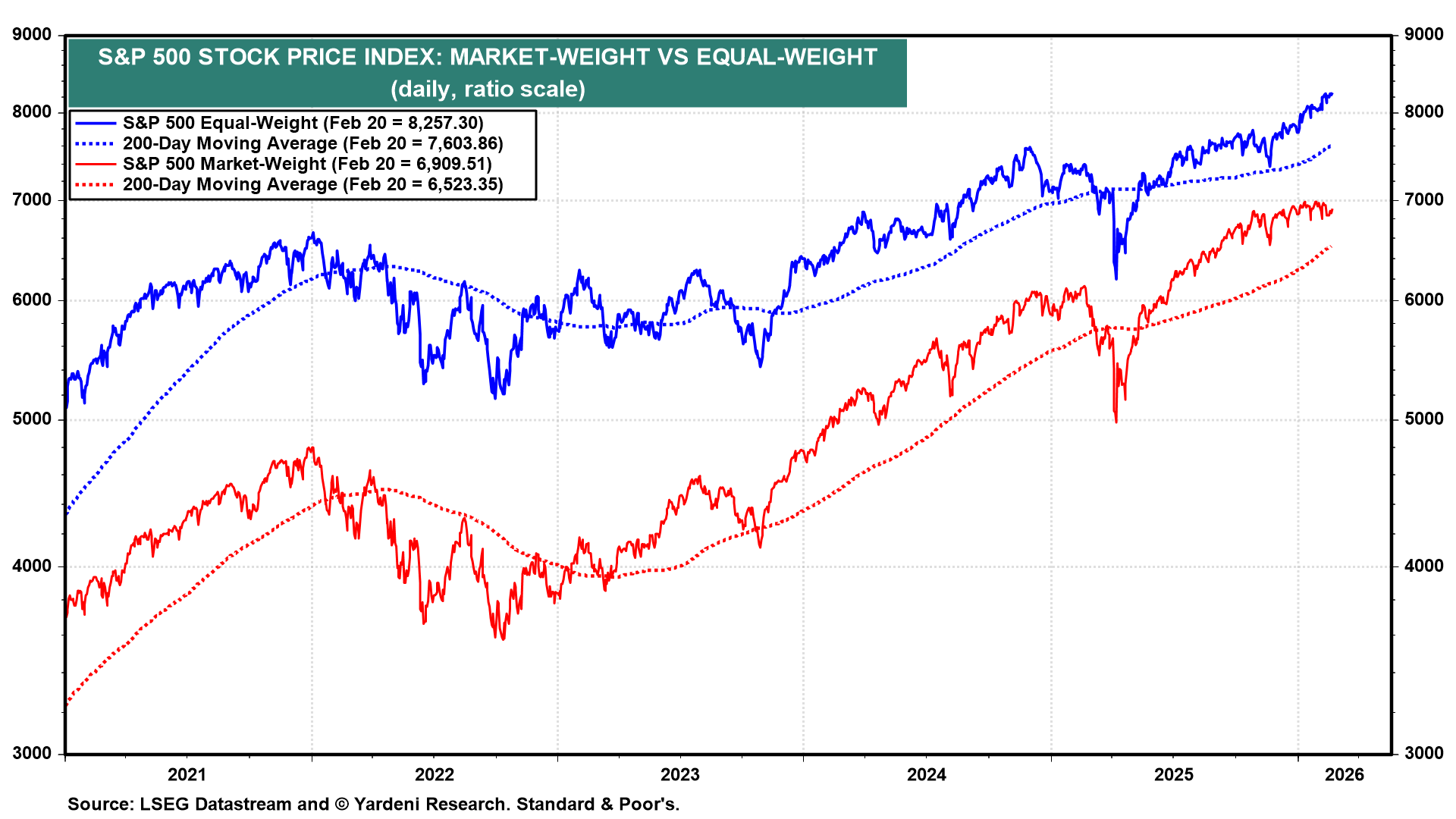

The equal-weight S&P 500 has been rising to record highs since the beginning of the year, while the market-weight S&P 500 has been literally loopy just below 7000 over the same period (chart). This has been mostly attributable to the stock market’s rotation in the type of outperforming stocks, from high-tech to low-tech industries. Previously, the former were supercharged by expectations that companies involved in AI were sure winners, while the latter lagged because investors figured it would take a while before AI benefited them. However, once the hyperscalers began massively increasing their spending on AI infrastructure, investors feared that the investments might not pay off. This mounting uncertainty triggered a rotation from high-tech industries that had gained much market-cap share in the S&P 500 to low-tech industries with much smaller market-cap share.

So far this year, investors have favored the S&P 500 sectors that are associated mostly with the physical and analog world rather than the virtual and digital world (chart). That makes a lot of sense because much of the AI capital spending boom will boost demand for oil and gas, electricity, materials, capital equipment, and real estate.

Furthermore, the geopolitical backdrop remains unsettled and unsettling. A military confrontation between the US and Iran seems increasingly likely, which has sent the price of a barrel of Brent crude oil up by more than $10 since the start of the year. This explains why the S&P 500 Energy sector has been the best-performing S&P 500 sector so far this year (chart). Yet the transportation stocks included in the S&P 500 Industrials sector have continued to rise to record highs. Defense stocks, which are also part of the Industrials sector, have been very strong so far this year. Rising geopolitical risks and uncertainties have been bullish for precious metals, which are included in the Materials sector. Base metal prices are rising amid growing demand driven by booming AI capital spending.

No comments

Be the first to comment.